Industry News Phoenix Arizona

Metro Phoenix Million Dollar Home Sales Soar, But Who Can Afford Them – Arizona Republic | 1/19/2020 | Catherine Reagor

A lot more millionaires are buying metro Phoenix homes.

Sales of homes priced at $1 million or more in the Phoenix area have jumped 36% during the past six months, according to the Cromford Report. In 2019, a record 2,132 houses with seven-figure price tags changed hands Valley-wide. That’s up 7.6% from 2018.

And the pace isn’t slowing down. “So far in January, sales priced at $1 million or more are already 54% higher than in early 2019,Tina Tamboer, senior analyst with Cromford, told 375 real estate agents earlier this week at Bobby Lieb's HomeSmart Elite meeting.

Metro Phoenix Named Hottest Housing Market – Arizona Republic | 1/12/2020 | Catherine Reagor

Metro Phoenix is the “hottest” housing market in the U.S. because home prices aren't expected to fall in the area as in other parts of the U.S. according to real estate analyst John Burns, a respected, national real estate expert. Read more about why Phoenix is Hot!

Census Report Ranks Arizona 3rd in Percentage Growth Rate – AZBigMedia | 1/2/2020 | AZ Business Magazine

Arizona ranked third in percentage growth rate in 2019, according to estimates released this week by U.S. Census Bureau. Arizona welcomed more than 120,000 residents from 2018 to 2019, a growth rate of nearly 1.7 percent, which bests states like Utah (1.662), Texas (1.283), Washington (1.210), Colorado (1.185), Oregon (0.857) and New Mexico (0.195).

With a nearly 1.7 percent growth from July 2018 to July 2019, Arizona jumped from fourth to third-highest rate of growth in the nation. The state also ranked third in the number of new residents with more than 120,000 newcomers. Only Texas and Florida added more residents.

Lucid Motors Casa Grande Factory to create nearly 5000 Jobs in Arizona – Arizona Republic | 12/3/19 | Russ Wiles

Lucid Motors on Monday marked the start of construction of its electric-car manufacturing plant in Casa Grande — a project expected to lead to 4,800 direct and indirect jobs over the next decade. The first phase of factory construction, representing an investment of more than $300 million, is scheduled for completion in late 2020, with production of Lucid’s first car, the Air luxury sedan, starting after that.Company officials say the vehicle will have a range of more than 400 miles and will be able to hit 60 miles per hour in under 2.5 seconds.

"This is the first true inter-city car," said Peter Rawlinson, Lucid's chief executive officer and chief technology officer, in reference to the 400-mile range of the Lucid Air. But with an expected sales price "north of $100,000," the vehicle clearly will have a narrower luxury niche.

Metro Phoenix Home Prices to Hit New Record High – Arizona Republic | 11/10/19 | Catherine Reagor

Metro Phoenix home prices are poised to hit a new record this month as lower interest rates continue to entice more home buyers, while the number of houses for sale shrinks. The area's median home price is expected to climb from $280,000 to $285,000 in November, based on pending sales.

Bidding wars for homes priced below $350,000, particularly by investors paying cash, are common. A growing number of first-time buyers are getting beat out by those investors, who are driving up prices. In September, housing analysts called metro Phoenix’s housing market “a bit frothy” and compared it to the 2004 market.

What's Being Done About Arizona's Growing Housing Affordability Problem – Arizona Republic | 11/3/19 | Catherine Reagor

Metro Phoenix home prices hit a new record this year. Valley rents are climbing to new records almost every month. Incomes aren’t keeping pace, and more people are getting squeezed out of homes as evictions set records too. The number of people living without shelter in the Phoenix area has jumped 200% since 2014. Metro Phoenix residents are dealing with the region’s worst housing affordability crunch.

The Arizona Housing Coalition’s annual meeting in Phoenix last week was packed with housing advocates trying to help a growing number of struggling renters vie for a dwindling supply of affordable homes. No one wants to see metro Phoenix’s problem turn into a housing crisis as it has in San Francisco, Los Angeles, Seattle and New York.

The Arizona Community Foundation kicked off its “Courage to Listen, Learn and Act series on affordable housing” at the state housing meeting. Creating affordable housing isn’t easy. The projects typically require various sources of funding, more services for tenants and must compete for land with the Valley’s many new upscale apartment projects.

Why It's Hard to Find a Metro Phoenix Home for the Median Price of $280,000 – Arizona Republic | 8/25/19 | Catherine Reagor

Metro Phoenix's median home price is still hovering at a record $280,000, but finding a house for that price can be tough.

Forget trying to buy a detached home in Gilbert, Tempe, Scottsdale, Paradise Valley, Carefree or Cave Creek around that price. Condominiums can be found for less than $280,000 in some of the areas, however. It's no surprise there aren't affordable homes in the Valley's poshest enclaves, but the East Valley suburbs were affordable not too long ago.

What's making it tougher for buyers who can afford the median price for detached houses is the drop in supply of those for sale, said Tina Tamboer, senior housing analyst with the Cromford Report. The number of Phoenix-area homes for sale is down 9% from last month, according to the latest count from the Arizona Regional Multiple Listing Service.

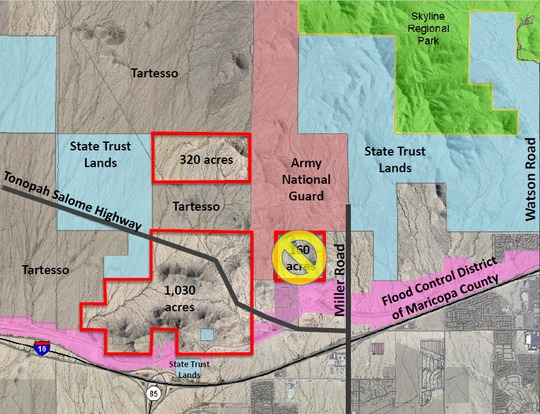

Feds may hand over 1,400 acres of BLM land to Buckeye; city envisions its own 'Central Park' – Arizona Republic | 6/28/19 | Joshua Bowling

The feds may give Buckeye nearly 1,400 acres of land west of the White Tank Mountains that the city is eyeing for a pair of parks, including one dubbed "Buckeye's Central Park." When it comes to park land per capita, Buckeye towers over other West Valley cities with 140 acres per 1,000 residents. That's because of the massive Skyline Park that Buckeye opened in 2016 on 8,700 acres of leased federal land at the southern edge of the White Tank Mountains. Click below to read entire article.

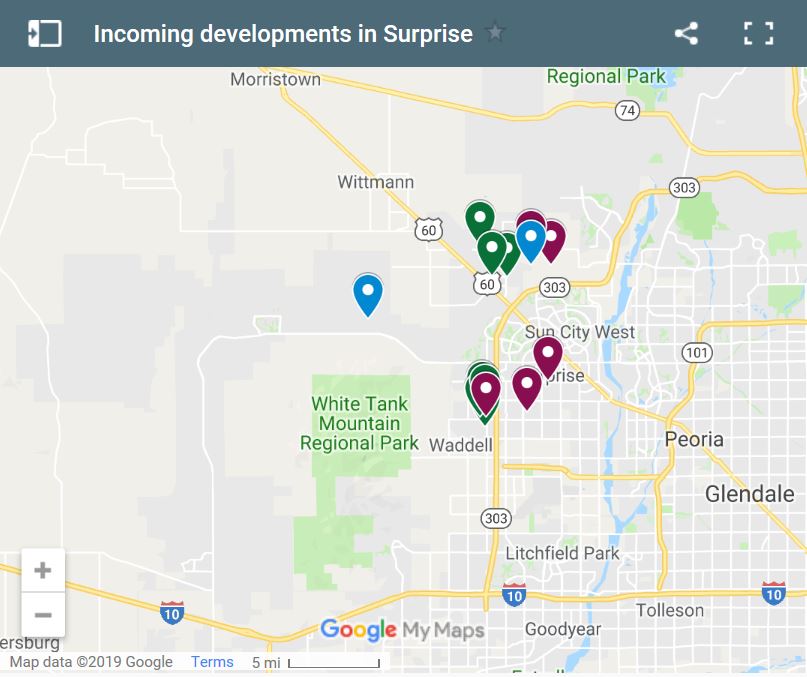

Thousands of new homes planned for Surprise, Arizona.

Surprise Arizona is one of the fastest growing cities in Arizona growing from approximately 30,000 residents in 2000 to around 118,000 in 2010, according to the US Census. The growth continues with at least nine major housing developments on the horizon planned for the next five or so years, bringing nearly 7000 new homes to the area. Read more in the link to the following article.

Development Marches Past the Edge of Metro Phoenix – Arizona Republic | 6/22/19 | Jen Fifield and Riley Murdock https://www.azcentral.com/story/news/local/surprise/2019/06/22/surprise-grows-quickly-residents-question-if-its-growing-right-way/1491785001/?utm_source=azcentral-News%20Alert&utm_medium=email&utm_campaign=news_alerts&utm_term=news_alert

Arizona ranks 4th in the nation for GDP growth – AZBIGMEDIA | 6/22/19 | AZ Business Magazine

According to data released today by the U.S. Bureau of Economic Analysis, Arizona’s real gross domestic product (GDP) increased by four percent in 2018, the fourth fastest growth rate in the nation. Arizona’s GDP growth outpaced that of 46 other states including California (3.5%), Florida (3.5%), and Texas (3.2%). Sectors including manufacturing, real estate and rental leasing, and construction contributed the most to Arizona’s GDP growth over the last year.

“A growing economy means more job opportunities, bigger paychecks for Arizonans and more investments in the things that matter, like education, child safety and public safety,” said Gov. Doug Ducey. “Our growth continues to be driven by Arizona’s hardworking employees, job creators and innovators. We remain focused on creating the best economic environment and ensuring sustainable, responsible growth.”

Not only is Arizona’s economy growing at one of the fastest rates in the nation, Arizona’s median household incomes recently reached a record high of $61,125. Arizona also recently ranked third in the U.S. for economic momentum, fourth for population growth and fifth for personal income growth. Maricopa County, Arizona’s largest county, led the nation with the largest population increase of any county in the nation in 2018. More than 298,000 new jobs have been added in Arizona since 2015, and the state is projected to add another 165,000 new jobs by 2020.

Buckeye, Phoenix are fastest growing cities in the United States – Arizona Republic | 5/23/19 | Jessica Boehm

Two Arizona cities are the fastest growing in the US, according to population estimates released by the US Census Bureau Thursday. Buckeye's population saw the largest percentage growth of any city in the country, growing its size by 8.5% between July 1, 2017 and July 1, 2018,. It now has a population of 74,370. Phoenix saw the largest numeric increase during that time frame, adding 25,288 people for a total population of 1,660,272. This is the third year in a row that more people move to Phoenix than any other city in the country. Click below to read full story:

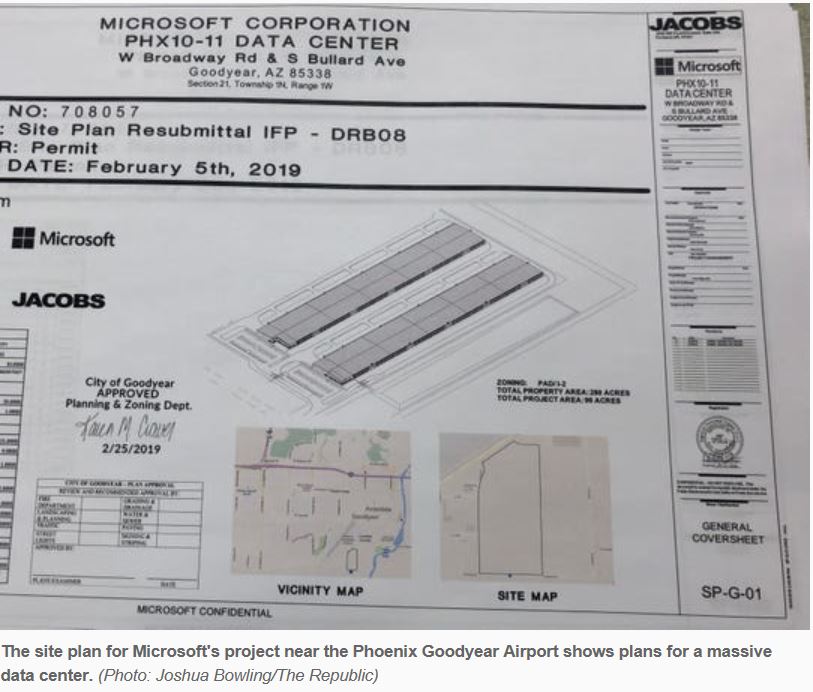

Microsoft continues Arizona expansion, spends $20M on El Mirage land to build data centers – Arizona Republic | 5/1/19 | Joshua Bowling

Microsoft continued its march through metro Phoenix's west side on Tuesday, spending $20.3 million on 151 acres of El Mirage land it intends to use for more data centers, the company confirmed. The land, south of Olive Ave between Dysart and El Mirage roads, is the tech giant's third major land grab in recent months. The company is planning data centers for two sites in Goodyear on a piece of land near the Phoenix Goodyear Airport and another near the Arizona State Prison complex - Perryville. Click below to read full story:

Metro Phoenix home prices set to hit a new record. Here's where buyers may find deals – Arizona Republic | 4/29/19 | Catherine Reagor

Prospective homebuyers who have their fingers crossed that metro Phoenix home prices will crash this year so they can find deals will be disappointed. The Valley’s median home price is poised to hit another record. Many buyers are scouring for deals as last year’s Phoenix-area median home price hit $268,000 in June, an all-time high...Farther out, home prices in Pinal County in the far southeast Valley and in Buckeye in the far West Valley are much lower than suburbs closer in. The trade-off there is a longer commute. Home prices in those affordable areas, too, are climbing faster than many other neighborhoods. Median home prices in the suburbs of Apache Junction, Casa Grande, San Tan Valley, Maricopa, Avondale, El Mirage, Tolleson and Buckeye are below $250,000. Click below to read full story:

Maricopa County named fastest growing county in the US third year in a row – Arizona Republic | 4/18/19 | Jessica Boehm

More people moved to Maricopa County than any other county in the nation last year, according to US Census Bureau population estimates released Thursday. This is the third year in a row that the county led in growth. Maricopa County added 81,244 people between July 2017 and July 2018. That's up from 74,000 during that same time period the year before. Maricopa County's growth helped it maintain its rank as the fourth most populous county in the country with 4,410,824 residents. Click below to read full story:

Goodyear plans new city hall as part of $83M Civic Square project – Arizona Republic | 4/17/19 | Joshua Bowling

Goodyear leaders say they've outgrown their digs and plan to build a new city hall and library with a 2-acre park, 100,000 square feet of office space and room for events, all as part of a project dubbed Civic Square. Civic Square is expected to finish in mid-2022. Click below to read full story:

Report: Hispanics Drive Homeownership Growth – Realtor Magazine | 4/10/19 | Excerpt

Hispanics are fueling homeownership growth in the U.S. They represented 62.7 percent of the increase in the U.S. net homeownership rate from 2008 to 2018, 81 percent of the U.S. labor force growth, and 32 percent of U.S. household formations, according to the 2018 State of Hispanic Homeownership Report, released Tuesday.

“Hispanic household growth continues to outpace that of the overall U.S. household growth and is anticipated to do so for the foreseeable future,” the report notes. Overall, the U.S. homeownership rate among the Hispanic population grew to 47 percent in 2018, marking the largest net gain since 2005.

“Despite concerns about housing inventory and changing government policies related to homeownership, the leading indicators, such as household formation, income trends, age, and consumer sentiment, suggest that Hispanics will continue to drive homeownership gains in America,” according to the report.

Hispanics have been the only ethnic demographic group to increase their homeownership rate in each of the past four years, the report notes. The Urban Institute has predicted that Hispanics will account for more than half of all new homeowners over the next several years and for 56 percent of all new homeowners by 2030.

The states and territories with the highest homeownership rates of Hispanics include Puerto Rico (68.56%), New Mexico (65.5%), Texas (56.86%), Wyoming (56.63%), and Michigan (56.13%).

This year's report also notes additional findings, including:

- Household formation: Hispanics formed 485,000 new households in 2018, accounting for 32.4 percent of total U.S. household formations. Between 2015 to 2025, Hispanics are projected to increase by 4.6 million households in the U.S.

- Population trends: At 58.9 million people, the Hispanic population represents a rising share of the U.S. population at 18.1 percent of the overall population. Hispanics are the nation’s largest ethnic minority and have accounted for more than half of total U.S. population growth since 2000, according to the report.

- Household composition: At an average of 3.7 persons per household, Hispanic households tend to be larger than the U.S. average of three. Hispanic households are also more likely to be multigenerational.

- Income trends: The Hispanic median household income grew to $50,486, the largest increase in income among all racial or ethnic population groups.

Developer breaks ground on West Valley community of 3,000 plus homes – KTAR.com | 4/9/19 | Excerpt

A Canadian developer broke ground last week on a master-planned residential community with room for thousands of houses in the West Valley. Brookfield Residential’s 1,130-acre Alamar development will feature up to 3,695 home sites, a 41-acre regional park co-developed with the city of Avondale and an elementary school. “Alamar will be a huge attraction as additional companies choose Avondale and the West Valley for their new corporate locations,” Avondale Mayor Kenneth Weise said in a press release.

The first phase, which is expected to open in late 2020, will have 461 home sites within five distinct neighborhoods. The single-family houses will range from 1,400 to 4,500 square feet and cost from the low $200,000s to the high $300,000s, according to a 2018 Avondale press release. Brookfield’s most notable existing development in Arizona is the 3,200-acre Eastmark community in east Mesa

Goodyear Continues To See Exponential Growth – All About Arizona News | 2/26/19 | Excerpt

Goodyear is the next city destined for exponential economic growth in the Valley region. Many credit its potential due to its large amount of freeway frontage, its regional airport, and an abundance of available land. The city is a highly educated community, filled with residents who would rather work close to home than commute to Phoenix every day.

A new 2 million-square-foot building, planning to be built by Stream Data Centers, further cements the city’s position as an economic powerhouse. The company isn’t the first to choose Goodyear as an ideal place to host a new facility. Microsoft Corporation recently purchased land to build a new facility in the region. On Monday, Goodyear City Council voted unanimously to approve an accelerated construction schedule for a Microsoft project. The developer agreement will allow the tech company to begin construction on the 279 acres in the city before completing some of the usual requirements.

Goodyear also has a growing industrial area that has become the home of Dick’s Sporting Goods, REI, Chewy warehouses. The Estrella Falls shopping mall is rumored to open soon, as well.

Jerry Colangelo developing ambitious West Valley ‘city of the future’ – KTAR.com | 1/23/19 | Excerpt

PHOENIX – The future is finally here – or at least getting closer – for Jerry Colangelo’s ambitious master-planned community in the far West Valley. The Phoenix sports mogul’s real estate company, JDM Partners, first purchased the Douglas Ranch property in Buckeye in 2002, with an eye toward building a “city of the future” that will be home to nearly 300,000 residents — more than currently live in all but three Arizona cities (Phoenix, Tucson and Mesa).

The joint project of JDM and El Dorado Holdings will cover 37,000 acres with plans for more than 100,000 residential units and 55 million square feet for office and retail use. “We’re ready to bring 1,000 lots to the market in the next year and a half,” Jim Kenny, El Dorado president, told the Phoenix Business Journal last week.

Here are some more details about Douglas Ranch from the development’s website:

- It has been designed for 290,000 residents.

- It will have 29 elementary schools and six high schools.

- Approximately 7 acres will be parks/open space.

- The property is generally bounded by Jomax Road alignment on the north, Thunderbird/Cactus Road alignments on the south, 319th to 328th avenue alignments on the east and 379th and 355th avenue alignments on the west.

- Buckeye will provide water and sewer service, and Arizona Public Service will provide electricity.

415 Jobs at Window Manufacturer and a Tech Campus coming to Goodyear – Arizona Republic | 1/14/19 | Joshua Bowling (Excerpt)

Ground was broken on a window manufacturing facility expected to bring 415 full-time jobs to Goodyear just days after a tech company announced plans for a 1 million-square-foot campus in the city.

Bayport, Minnesota-based Andersen Corp. has officially started construction on its facility in Goodyear's industrial corridor, west of the Phoenix Goodyear Airport.

The groundbreaking came days after Santa Clara, California-based Vantage Data Centers announced plans to build a 1 million-square-foot campus in Goodyear. The Goodyear plant will be the company's largest.

The sites join a growing roster of manufacturing and tech jobs coming to Goodyear in recent months.

Andersen entered a 10-year agreement with Goodyear that requires 51 percent of its jobs to pay minimum annual salaries of $41,133 and the rest to pay at least $31,200. The facility is expected to open in 2020. Most of the jobs in the 546,000-square-foot facility will be production positions, but there will also be engineering jobs, maintenance technicians and supervisors.

Vantage Data Centers also joined the lineup. The company on Tuesday said it purchased 50 acres of land on the southeast corner of Van Buren Street and Bullard Avenue. The site will be used for three data-center buildings and office space, the company said. It will be the largest Vantage campus once it's fully developed. Construction is expected to begin early this year; the campus is expected to be operational in 2020. Vantage isn't ready to announce how many jobs are coming to the campus, a company spokeswoman said.

Goodyear has nabbed a number of prominent employers in the last year. In 2018, Goodyear attracted:

- A Ball Corp. aluminum can manufacturing plant.

- A UPS Inc. internet fulfillment center.

- A Chewy Inc. internet fulfillment center.

The three were expected to create a combined 1,200 full-time jobs by the end of 2019.

Is a housing crash looming for metro Phoenix in 2019? Experts Weigh In– Arizona Republic | 1/13/19 | Catherine Reagor (Excerpt)

Buyers holding out until metro Phoenix home prices begin to plummet aren’t likely to become homeowners this year. Valley home prices are poised to most likely climb at a slower pace or possibly flatten out during 2019. But home values will not fall as they did during the real estate bust of 2008-11, real-estate analysts predict, looking at the numbers and not crystal balls.

“The supply of homes for sale increased, and sales slowed during the last three months of 2018,” said Tina Tamboer, senior housing analyst with the Cromford Report at a meeting of more than 125 Valley HomeSmart real-estate agents Tuesday. "But nothing in the current data shows a market crash coming for Phoenix." She said it's still a sellers' market, but Valley homeowners shouldn't expect the steep annual price increases we've seen during each of the past few years.

Home prices recovered from the crash last summer to reach $268,000 and then slipped back down to $262,000 this fall. But if inflation is taken into account, Valley home values are still more than 10 percent behind 2006’s boom levels. Final home price numbers and sales for 2018 are still being tallied.

Housing market watchers including Realtor.com are calling for metro Phoenix home prices to climb between 4 and 6 percent this year based on pending sales, population projections and recent job growth numbers.

That compares to 6 to 8 percent annual home price increases during the past few years. Valley home sales slowed during the end of the last year but could end up being on par with 2017’s pace. That year was the third best year ever for sales.

Veteran agent Bobby Lieb, who held the HomeSmart meeting, has seen several real-estate cycles and said he doesn’t see a crash coming either. When I asked the HomeSmart crowd if they thought metro Phoenix home prices would climb, flatten or fall this year, the votes were almost evenly split among the three scenarios.

That was even after HomeSmart executive Wendy Forsythe told the group 96 out of 100 top national economists don't expect a housing crash this year. It’s understandable why anyone who lost a home or job as many did during the crash in metro Phoenix would be wary of a repeat. But for now, the numbers don’t show it happening again anytime soon. Fingers crossed.

New Online Report Card: See How Your School Measures in Test Scores, Graduation Rates – Arizona Republic | 1/17/19 | Lily Altavena

New online report card: See how your school measures in test scores, graduation rates

The Arizona Department of Education has published a slew of data about the state's schools, all in one place.

The data include information about individual schools, including how students performed on tests, how many children were disciplined at the school and how many teachers at that school hold emergency certificates.

They also give a picture statewide about who Arizona's students are and how they're performing.

Rents in Phoenix among the fastest-rising in the country – Tim Gallen, Digital Editor | 1/2/19 | Phoenix Business Journal

Rents in Phoenix climbed more than 7 percent in 2018, a growth rate eclipsed by only one other city in the country.

In its year-end analysis, RentCafe pegged rent growth in Phoenix at 7.7 percent among large cities in 2018. Only Las Vegas saw rents rise faster than Phoenix among large cities for the year. Sin City rents climbed 7.9 percent. "Cities like Las Vegas, NV and Phoenix, AZ have proven to be viable alternatives to big cities with suffocating housing costs for many," according to RentCafe's report. "The increased demand is showing its effects, having kept Las Vegas firmly at the top of the list, and shooting Phoenix all the way to second place for rent growth among large markets."

Average rents in Phoenix are $1,011, according to RentCafe. That strong demand in Phoenix also bleeds out to suburban communities in the Valley, as Mesa rents climbed at an even higher rate — 8.3 percent last year. That rapid pace shot the East Valley city — which was been the center of a number of economic and business activity in 2018 — to the top of RentCafe's mid-size cities list. On the other side of the Valley, Peoria also experienced eye-popping rent increases. The West Valley city saw rents climb 9.3 percent, according to RentCafe, which placed it among the five fastest-growing small cities in the nation.

Average rents in Mesa and Peoria are $974 and $1,137, respectively, according to RentCafe. Scottsdale rents climbed 7.5 percent for the year, with average monthly rents of $1,433, while Tempe saw rents climb 4.8 percent in 2018 with average monthly rents of $1,302.

The Valley's strong economy in 2018 led to a continued apartment boom with several new projects underway in popular submarkets including downtown Phoenix and Scottsdale. That healthy demand also led to investors scooping up existing and aging properties with an eye toward renovations and higher rents.

Census shows Arizona is 4th fastest-growing state in United States – Associated Press | 12/20/18 | excerpt

New census figures show Arizona is the fourth fastest-growing state in the United States. The latest numbers released Thursday show that more than 122,000 people moved to Arizona between July 1, 2017, and July 1, 2018. That a 1.7 percent growth rate for that period. Arizona had an overall population of 7,171,646 by the middle of this year.

Phoenix, Buckeye among biggest, fastest growing cities in U.S. in 2017 – Cronkite News | 5/28/18 | Dani Coble (Excerpt)

Two Arizona cities were among the fastest-growing in the nation in 2017, according to population estimates released Thursday by the Census Bureau.

The bureau’s “2017 City/Town Population and Housing Unit Estimates” said Phoenix saw the second-biggest increase among cities in nation, adding 65,852 new residents over the course of the year, or almost 66 people per day.

That trailed top-ranked San Antonio by just 172 people – or less than half a new resident a day – and was well ahead of third place Dallas, which added 18,935.

The report also said Buckeye saw the fifth-fastest growth rate in the U.S. last year among cities with more than 50,000 residents. Buckeye added more than 3,800 people, according to Census estimates, a 5.9 percent growth rate that brought its estimated total population to 68,453.

It was a continuation of the boom in population for the town, which posted the seventh-fastest growth among 2016 and has grown more than tenfold since 2000, when there were fewer than 6,000 people living in the city.

Housing Market Nearly Recovered from Recession – Housing Wire | 3/1/18 | Kelsey Ramirez (Excerpt)

CoreLogic, a global property information, analytics and data-enabled solutions provider, released a report outlining the real estate economy from 2006 to 2017, showing that the housing market has nearly completely recovered from the recent recession.

New home sales 10-year high baffles economists – Housing Wire | 10/25/17 | Kelsey Ramirez (Excerpt)

After hitting a new low in August, new home sales surged in September to their fastest pace in the past decade, according to the latest report released jointly by the U.S. Census Bureau and the Department of Housing and Urban Development. Sales of new single-family houses in September surged to a seasonally adjusted annual rate of 667,000 sales, the report showed. This is up a full 18.9% from 561,000 new home sales in August and up 17% from 570,000 sales in September 2016. The increase marked the fastest pace of home sales in 10 years.

This sudden increase came much to the shock of economists, who said September would likely see a slight drop in home sales. However unexpected the news, experts were thrilled, saying this is the news they’ve been waiting to here. The report also showed that the difference of even just one month can change everything. The median sales price of new homes sold in September increased to $319,700, up from $300,200 in August. The average sales price came in at $385,200 for the month.

“The price gap between new and existing homes has narrowed since earlier this year, making new construction a more viable and competitive option for buyers,” Redfin Chief Economist Nela Richardson said. “This combined with a larger stock of new construction inventory makes new home construction a key driver in today's market.” Housing inventory fell to 279,000 new homes for sale, down from 284,000 new homes in August. This represents a supply of 5 months at the current sales rate.

Ever-mobile Millennial housing demand unchecked by rising mortgage rates - Housing Wire | October 6, 2017 | Kelsey Ramírez (Excerpt)

The housing demand among the ever-mobile Millennial generation went unchecked in August despite rising mortgage rates, according to the Ellie Mae Millennial Tracker. In fact, despite Millennials’ average 30-year note increasing to 4.211%, up from 3.706% last year, their loan amounts also increased in August to $185,919. This is up from $184,113 in August 2016. Further, the generation is showing a growing willingness to shun the big cities and settle down in once-sleepy towns.

So what exactly did the average Millennial homebuyer look like in August? Ellie Mae shows us they were just over 29 years old, and took out a conventional loan of $185,919 on a home with an appraised value of $223,882. Their FICO score was 724, and their 30-year mortgage note rate was 4.2%. These borrowers, of whom 52% were married, typically closed out their home-buying process in 44 days.

Of course, this picture varies in different regions of the U.S. On the West coast, for example, Millennials averaged nearly 31 years old and took out much higher loans at $314,579. In the Midwest, Millennials took out lower mortgages of just $158,584. Borrowers in Hawaii took out the highest loans at $396,766.

And in what may be a growing trend, Millennials are moving away from the larger metros. The top five markets with the highest percentage of Millennial homebuyers in August are: 1) Lima, Ohio, 2) Batavia, New York, 3) Dyersburg, Tennessee, 4) Roswell, New Mexico, 5) Kendallville, Indiana.

Here are metro Phoenix's hottest intersections to live, work and play – azcentral.com | Catherine Reagor, | Sept. 25, 2017 (Excerpt)

Uptown Phoenix was a hot spot for restaurants, shops and clubs in the 1970s and '80s. Then the cachet fizzled a bit as the Valley’s suburbs boomed. But Camelback Road and Central Avenue, the heart of Phoenix's uptown area, is back as a thriving hub for popular restaurants, cool boutiques, office space, light rail and historic neighborhoods. It's now the Valley's most popular intersection, according to a new poll among real-estate and growth experts.

Urban Land Institute Arizona members recently voted the central Phoenix spot the “hottest intersection” in metro Phoenix. It beat out Phoenix's Camelback and 24th Street, an area that garnered the title the last time the group voted a decade ago. “Camelback and Central has old buildings with great design, diversity and very supportive neighbors," said Craig DeMarco, restaurateur and a founder of Upward Projects, at the Urban Land contest last week. “It's the only intersection in the entire Valley with four historic neighborhoods surrounding it."

Camelback and Central didn’t even make Urban Land’s top 10 list for hottest intersections in 2007. A lot has changed since then. A boom and bust, light rail and a move toward an urban lifestyle by more Valley residents have shifted our growth.

Other rankings on Urban Land’s top 10 list:

- Downtown Tempe’s Mill Avenue and Rio Salado Parkway was voted No. 2 in the hot-intersection contest.

- Scottsdale and Camelback roads came in at No. 3, after hitting No. 2 the last time.

- Chandler’s Arizona Avenue and Chandler Boulevard tied for fourth along with Phoenix’s 24th Street and Camelback

- At No. 5 is the Scottsdale Road and Greenway Hayden Loop area, near the city’s popular airport.

- Downtown Phoenix’s Central Avenue and Roosevelt Street ranked No. 6 after not making the list a decade ago. The area, known as Roosevelt Row, has recently emerged as a hub for new apartments, condos, cool restaurants, historic renovations and light rail.

- Washington Street and Central in the heart of downtown Phoenix ranked No. 7, The city’s many new high-rises are attracting more residents and offices. ASU’s downtown Phoenix expansion is helping.

- Gilbert Road and Vaughn Avenue in restaurant-rich downtown Gilbert came in at No. 8.

- Phoenix’s 44th Street and Camelback intersection made the list at No. 9

Jobs and Housing Growth | Lucid Motors Car To Be Built in Arizona - All About Arizona News | 8/17/17 | Max Mahoney

The luxury electric car market is getting a little more cramped as Lucid introduces its Air model to challenge Tesla. The Lucid Air is impressive to say the least. Superior comfort (including 55 degree reclining massage seats and panoramic sunroofs), responsive user interface, a 240 mile range, 400 horsepower (rear wheel drive), ample storage space, and a gorgeous exterior are just few of the amenities packed into the Air’s base model, which is priced at a reasonable $52,000.

Lucid recently announced that it would manufacture the Air at its soon-to-be-built Casa Grande plant. The 500 acre, $700 million plant is set to open next year and will employ approximately 2,000 people by 2022. Lucid believes that the plant will be able to produce 22,000 cars annually, with the possibility of producing 130,000 annually at full production. The Air’s amenities and Lucid’s ambitious production goals are enough to give Tesla a run for its money.

Home Prices Hit Another New All Time High – Housing Wire | 8/16/17 | Kelsey Ramirez

Home prices increased in the second quarter of 2017 to yet another all-time high due to low levels of housing supply, according to the latest quarterly report from the National Association of Realtors. The national median existing single-family home price increased 6.2% in the second quarter to $255,600. This is up from the second quarter of last year when home prices came in at $240,700, and surpassed the third quarter of 2016’s $241,300 as the new peak in quarterly median sales price.

“The 2.2 million net new jobs created over the past year generated significant interest in purchasing a home in what was an extremely competitive spring buying season,” NAR Chief Economist Lawrence Yun said. “Listings typically flew off the market in under a month, and even quicker in the affordable price range, in several parts of the country.” “With new supply not even coming close to keeping pace, price appreciation remained swift in most markets,” Yun said.

Homebuilders’ Confidence Rises with Demand for New Homes – Excerpt from Housing Wire | 8/15/17 | Kelsey Ramirez

Confidence among home builders grew in August alongside the rising demand for new homes, according to the National Association of Home Builders and Wells Fargo Housing Market Index. Derived from a monthly survey that NAHB has been conducting for 30 years, the index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as good, fair or poor.

“The fact that builder confidence has returned to the healthy levels we saw this spring is consistent with our forecast for a gradual strengthening in the housing market,” NAHB Chief Economist Robert Dietz said.

2017 will probably be the Biggest Year for Homebuilders in a Decade – Housing Wire | 7/19/17 | Kelsey Ramirez

After housing starts increased in June, experts weighed in, explaining why 2017 could be the best year for new construction in a decade. Experts explained the growing imbalance between the number of homes for sale and the demand allowed builders to construct more homes. “Most likely a result of the trending imbalance between homes for sale and demand for new homes to purchase, housing starts finally edged up in the month of June to 8.3%,” said Greg Parsons, Semper Capital Management CEO and head of investment committee. “The need to balance the growing demand for housing with a dwindling supply, coupled with a strong economy, has given builders an opportunity to break ground and build more homes.”

Building permits for single-family housing also increased, showing the uptick in housing starts in June will continue in the months to come. One expert, who served as Fannie Mae’s chief economist for more than 20 years, says the upward trend will continue throughout 2017. “With new home sales and household formations still moving higher, we expect that housing starts will increase further in 2017, although there will be months in which they are down temporarily,” Nationwide Chief Economist David Berson said. “For all of 2017, total starts should be around 1.25 million units, the highest level since 2007.”

“Though a recovery in housing starts in June is welcome news, more consistent gains are needed to help rebalance the housing market,” said Lawrence Yun, National Association of Realtors chief economist. “The latest 1.22 million in total housing starts is still well below the historical average of 1.5 million.” “That is why the country is experiencing a stubborn housing shortage,” Yun said. “With rising population and steady job gains, drastically more new home construction is needed to fully and satisfactorily house new households that will be formed this year and upcoming years.”

More Americans than ever say Now is Good Time to Sell their Home – Excerpt from Housing Wire | 7/7/17 | Kelsey Ramirez

Americans are more confident about housing in June as sentiment levels returned to the previous high. The Fannie Mae Home Purchase Sentiment index increased 2.1 percentage points to 88.3 in June, matching the all-time high set in February. The increase is due to four of the six HPSI components which increased during the month.

“The June HPSI reading matches the previous record set in February and reflects the trend toward a sellers’ market that respondents indicated last month,” said Doug Duncan, Fannie Mae senior vice president and chief economist. “Consumers are also growing more optimistic about their ability to get a mortgage, and lenders expect credit standards to ease further going forward, as shown in our Mortgage Lender Sentiment Survey.”

The number of Americans who said now is a good time to sell hit a new record high for the second consecutive month as it increased seven percentage points to 39%. This outpaced the three percentage-point increase of those who said now is a good time to buy, which increased to 30%. Once again, the gap between those saying now is a good time to sell and those saying it is a good time to buy widened once again as the housing scene continues to shift to a seller’s market.

Phoenix is the nation's 5th largest — but is it a 'real' city? - The Republic | azcentral.com | 6/12/17 | Brenna Goth

A lot of kids who grow up in Phoenix think that one day they’ll move to a big city. Technically, that leaves few options in the U.S. Phoenix is now the firth-larges by population. Its land area exceeds New York City, Los Angeles and Chicago. The number of people who live here lags those cities, and Houston, but surpasses all others.

But those looking for a "big city" don’t mean a place with more residents or square miles. People associate them with skyscrapers and trains and more than one busker playing electric guitar downtown on a Friday night. As Phoenix well knows, big doesn’t equal urban. It's a concept I learned early as a Millennial who was born in the Valley suburbs, grew up downtown and spent a spell in Mexico City before coming back home. Critics again called Phoenix out as one of the nation’s largest suburbs when the city surpassed Philadelphia in the U.S. Census Bureau’s most recent population estimates. It’s OK that Philly fell in the ranking, they said, because at least it’s a “real” city.

In terms of development, Phoenix looks more like a real city than it has in decades. Since it lost its top-five population spot in 2010, new apartments, university buildings and residents have transformed downtown. Neighborhoods outside the urban core are bustling with hubs of bars and restaurants. Phoenix has an estimated 1,615,017 residents, according to the U.S. Census Bureau. More people moved here from July 1, 2015, to July 1, 2016, than any other city in the country, according to the census. The flap over size raises a question: Will Phoenix ever have the cachet of cities such as Philadelphia, Seattle or San Francisco — or is that even our goal? Read More

Phoenix Housing Boom New Home Sales Rise 22 Percent - All About Arizona News | 6/1/17 | Franklin Barnhart

According to Belfiore Real Estate Consulting, a full service market research firm based in Phoenix that provides residential data and analyses, new-home sales rose 22 percent in the Phoenix area over the past month. The significant influx in sales is being attributed to rising interest rates, and the expectation home prices will rise soon in the Valley. President Jim Belfiore, who has more than 15 years of experience in market research, said: “Demand for new homes is healthy. Between mid-April and -May, more new homes sold in the Valley than any other period in the past decade.” However, it seems the healthy housing market is also exposing some unexpected challenges. There is a serious construction labor shortage around the Valley due to the last housing downturn. A vast number of construction workers left Arizona to seek opportunities in other states and haven't returned. In an attempt to lure more skilled construction workers back to the Valley, contractors are charging up to 50 percent more to offer them higher wages. This translates to higher prices for new-home buyers. In addition, Phoenix-area builders are also facing higher land and lumber costs now.

Here are some other interesting statistics regarding Phoenix’s housing market:

- $302,000 - The approximate median price of a new metro Phoenix house (2017).

- 2.8% - Ballpark percentage that new-home prices in metro Phoenix climbed (2016).

- 19,000 - Approximate number of new homes that were built across the region last year.

Fannie Mae’s New Student Debt Relief Programs to Ease Burden, Offer Expanded Eligibility! - Housingwire.com | 5/3/17 | Caroline Basile

Last week, Fannie Mae unveiled three new programs to help aid current homeowners and future homebuyers who are blocked from eligibility and financing by the burden of student debt. Fannie Mae first announced an expansion of its cash-out refinance program with SoFi. The GSE also announced the implementation of two other programs to help widen eligibility for borrowers. One helps potential borrowers whose debt is paid by others. The third solution allows lenders to accept student loan payment information on credit reports, making it easier for student debt holders to qualify for a loan. So, how do these new programs help current homeowners and future homebuyers who are bogged down by student debt when financing a home? Here’s an outline of what each new solution does and how it can help.

Student loan cash-out refinance: This option offers homeowners the flexibility to pay off high interest rate student debt while potentially refinancing to a lower mortgage interest rate. Johnathan Lawless, Fannie Mae’s director of consumer outreach, said this option is ideal for parents who may have home equity to cash in on because it could be used to pay for their child’s education debt. But Lawless did warn that refinancing may negate any benefits the borrower receives in the original loan contract, such as the ability to enter into forbearance or an income-based repayment plan.

Debt paid by others: Fannie Mae has widened borrower eligibility by excluding from the borrower’s debt-to-income ratio any non-mortgage debt, such as credit cards, auto loans, and student loans, that are paid by someone else.

Student debt payment calculation: Fannie Mae has changed how student debt is calculated when applying for a mortgage, making it more likely for borrowers with student debt to qualify for a loan by enabling lenders to accept student loan payment information on credit reports. Lawless explained that if you’re on an income-based repayment plan, the lower payments will now count toward your debt-to-income ratio to help determine mortgage eligibility. “The day we announced this, I received a call from a lender who had a borrower on one of these plans and their monthly payment was $100, but because of the policy on how to put the debt into the ratio, they were actually using $600,” Lawless said. “We announced the change and they went back into the application and updated it to $100 and it went from not being approved to being approved.”

5 of Nation's Top High Schools are Arizona Charter Schools – The Arizona Republic | 4/25/17 | Jessica Boehm (Excerpt)

Five of the nation's top 10 high schools are in Arizona — and they're all branches of the same charter school. According to U.S. News and World Report, Basis Scottsdale is the nation's top-performing high school, followed by Basis Tucson North and Basis Oro Valley. Basis Peoria and Basis Chandler were ranked fifth and seventh, respectively.

The rankings consider students who exceeded state standards, graduation rates and college preparedness, according to U.S. News. Two additional Arizona charter schools, along with two "special function" public schools, made the top 100. Arizona was one of the earliest adopters of charter schools in 1994, and it continues to be at the forefront of school choice. However, the state has some of the lowest school funding and teacher pay in the U.S. Read full article

Now is the Time to Purchase a Home, Don’t Get Priced out of the Market! – RISMEDIA Daile e-News | 4/15/17

Home prices nationally kept on the upswing in February, rising 1 percent month-over-month and 7 percent year-over-year, according to CoreLogic®’s recent Home Price Index (HPI™). The HPI Forecast™ projects prices to rise 0.4 percent in March and 4.7 percent by February 2018. “Home prices continue to grow at a torrid pace so far in 2017 and these gains are likely to continue well into the future,” said Frank Martell, president and CEO of CoreLogic, in a statement on the Index. “Home prices are at peak levels in many major markets and the appreciation is being driven by a number of dynamics—high demand, stronger employment, lean supplies and affordability—that will continue to play out in the coming years. The CoreLogic Home Price Index is projecting an additional 5 percent rise in home prices nationally over the next 12 months.”

AZ Big Media - 3/28/17 - The West Valley is Growing! Real Estate is on the rise with 52-percent of the Phoenix area’s future growth is expected to occur in the West Valley. Continue Reading...

AZ Big Media - 3/28/17 - The West Valley is Growing! Real Estate is on the rise with 52-percent of the Phoenix area’s future growth is expected to occur in the West Valley. Continue Reading...

Maricopa County See Largest Population Growth - Excerpt from AZ Central -3/2317

Maricopa County See Largest Population Growth - Excerpt from AZ Central -3/2317

Good news for Maricopa County and the housing market. The Census Bureau says Arizona's Maricopa County has replaced Texas' Harris County as the county with the nation's highest annual population growth. Maricopa County includes Phoenix and most of its suburbs, and its estimated population now tops 4.2 million. Maricopa County gained more than 81,000 people between July 1, 2015, and July 1, 2016, an average daily increase of 222 people. Harris County had an increase of nearly 57,000, or about 155 per day on average.

As Phoenix Rent Prices Hit New High its a Good Time to Consider Buying a Home!

All About Arizona News - March 22, 2017

All About Arizona News - March 22, 2017

Phoenix has seen a burst in growth over the last few years with its burgeoning financial industry and influx of tech startups. As the amount of apartment complexes continues to increase in the Phoenix area, so does the cost of living there.

This past February, the average rent that a Phoenix resident pays each month reached a new all-time high. According to Axiometrics, an analytics firm that specializes in apartment and student housing, tenants in the Phoenix area are paying $976 a month compared to last year’s record high of $935.

Phoenix landlords are cashing in on the boom happening in Phoenix, as the city has a 94.6 percent occupancy rate. Landlords have witnessed a 4.4 percent increase of effective rent growth, as the average price of rent increased by $8 this past February.

Although Phoenix’s rent prices have increased, they are still far below the national average. Across the country, rents average at $1,285 a month. Nationally, there has been a rent growth of 2.3 percent. On average, the nation has a similar occupancy rate to Phoenix at 94.5 percent.

The top five submarkets in Phoenix February of 2017’s annual effective rent growth:

-

Central Phoenix North: 8.1 percent

-

Glendale South: 8.1 percent

-

Maryvale: 7.3 percent

-

Sunnyslope: 7.1 percent

-

South Mesa: 7 percent

Americans More Confident in Housing Than Ever Before!

RISMedia.com - 3/9/17

RISMedia.com - 3/9/17

Americans are more confident about their housing prospects than ever before, with more believing now is “a good time” to buy or sell a home, according to the just-released Fannie Mae Home Purchase Sentiment Index® (HPSI), which hit high point after high point in February. “The latest post-election surge in optimism puts the HPSI at its highest level since its starting point in 2011,” says Doug Duncan, chief economist and senior vice president at Fannie Mae. “Millennials showed especially strong increases in job confidence and income gains—a necessary precursor for increased housing demand from first-time homebuyers.”

The Index registered an all-time high, 88.3, in February. Forty percent of Americans surveyed in the Index believe now is a good time to buy a home, up 11 points from January, while 22 percent believe now is a good time to sell, up 7 points to an Index high. Seventy-eight percent—another Index high—believe they are secure in their jobs, and 19 percent—still, another Index high—report “significantly higher” incomes in the past year. Forty-five percent, at the same time, believe home prices will rise. “Preliminary research results from our team find that millennials are accelerating the rate at which they move out of their parents’ homes and form new households; however, continued slow supply growth implies continued strong price appreciation and affordability constraints facing millennials and first-time buyers in many markets,” Duncan says.

Metro Phoenix new-home prices ready to rise in 2017 - January 6, 2017 - Arizona Republic

Making a Comeback - Housing continues its rise - March 3, 2016 - Realestatebook

Rent Rates Rise Across US in 2016 - Jan. 5, 2017 Housingwire.com

See how much rent went up across America in 2016

Arizona cracks top 10 states for Newcomers - January 4, 2017

Arizona might be emerging as a hot destination for newcomers, according to a new survey that tracks state-to-state migration patterns. The annual report by United Van Lines places Arizona as the 10th-highest state for attracting people moving from other states during 2016. Arizona didn't crack the top 10 in the 2015 survey. In the 2016 study, South Dakota overtook Oregon, which had held the top spot for the previous three years. After South Dakota, Vermont placed second in attracting newcomers, followed by Oregon, Idaho, South Carolina, Washington, the District of Columbia, North Carolina, Nevada and Arizona. New Jersey had the highest proportion of people moving out, followed by Illinois, New York, Connecticut and Kansas.

Median Home Prices Hit All Time High - Nov. 3,2016 - Housingwire.com

First time single women homebuyers sales surge in 2016 - Nov. 1, 2016 - RisMedia

How Much Salary Do You Need to Buy a Home? - Sept. 7, 2016 - Apartment Therapy

Condo sales lead housing trend to Valley's city cores - 4/27/15 - Arizona Republic

For the first time, metro Phoenix is growing up more rapidly than out. A record number of high-rise, townhouse and loft housing developments are shooting up in central Phoenix, Scottsdale and Tempe, and selling out quickly. Condominium sales are climbing faster than regular home sales in the Valley, a reversal of the region's growth pattern since the 1950s. Two decades ago, Phoenix had more vacant infill land than any other city its size in the U.S. But over the past few years, builders have sparked bidding wars for vacant parcels and older buildings that can be turned into high-density, infill housing in the Valley. Empty nesters and Millennials who don't need as much space, want to drive less and be near restaurants and entertainment are moving closer in and changing the direction of Phoenix's housing market.

The Arizona Department of Transportation will deliver the Loop 202 South Mountain Freeway three years sooner and at a cost savings topping $100 million by taking an innovative approach to selecting the team to design, build and maintain the highway. The 22-mile freeway, expected to open by late 2019, will provide a long-planned direct link between the East Valley and West Valley and a much-needed alternative to Interstate 10 through downtown Phoenix and will complete the Loop 202 and Loop 101 freeway system. Construction is scheduled to begin in summer 2016.

What's in your Credit Score? - Feb. 3, 2016 - Housingwire

Metro Phoenix Home Prices Hit 7 Year High - ASU Report - azcentral.com, Feb. 17, 2015

Low Down Payment Mortgage Options Return - Feb. 17, 2015 Housingwire.com

Financing Help for First Time HomeBuyers and others hoping to enter the housing market.

Top Metro Areas Attractive to Baby Boomers - Dec. 11, 2014 Economist Outlook

No, Debbie Downer, Arizona's Economy isn't Dead - Oct. 24, 2014 - Robert Robb, columnist | azcentral.com

I suppose I should just give up trying to counterbalance the economic Cassandras who dominate the discussion in Arizona.

Phoenix housing market is slow, but there are positive signs - Catherine Reagor, The Republic | azcentral.com - Oct. 22, 2014

Sales and prices dipped slightly in September, according to the Arizona Regional Multiple Listing Service's latest Stat report.

Phoenix-area Foreclosures Continue to Fall - Catherine Reagor, The Republic | azcentral.com - Oct. 2, 2014

The number of metro Phoenix houses taken back by lenders through foreclosure fell to 405 in September, the lowest level since early 2007.

Nearly a third of Arizona schools get 'A' rating - 8/4/14 - Acentral.com

Nearly a third of Arizona's public schools received an "A" letter grade this year, according to data released by the state Department of Education on Monday. Of the district and charter schools in the state, 542, or 32 percent, received an "A" — 16 percent more than last year. Thirty-three percent of schools received a "B," 25 percent got a "C" and 10 percent got a "D" for 2013-14. Schools' letter grades are largely based on student scores on the Arizona's Instrument of Measure Standards tests, given in April every year. Half the letter grade is based on how much the lowest-performing students improve. The grades also consider progress in reducing the number of drop outs and moving non-English speakers toward regular classes.

Gilbert ranked No. 9 in U.S. for families - The Republic | azcentral.com, June 10,2014

WalletHub named Gilbert No. 9 among U.S. cities for families. The list compared the 150 largest communities in the U.S. and recognized Gilbert for its affordability, socio-economic demographics and education. Other Valley communities named in WalletHub's list of best cities for families include Scottsdale (28), Chandler (29), Peoria (32), Mesa (76), Glendale (92), Phoenix (93) and Tempe (108).

Goodyear, Gilbert Among Nations Fastest Growing Cities! - Associated Press, azfamily.com, 5/22/14

In figures released Thursday, Goodyear ranks sixth and Gilbert 12th for the country's 15 fastest-growing municipalities for 2012-13.

Survey Finds Benefits of Buying a Home Outweigh Renting - April 30. 2014, National Mortgage Professional

In half of U.S. metros, buying a home is a better financial decision than renting for homebuyers who plan to stay in their home for at least two years...

Zillow: Home Values in 1,000-Plus Cities to Rise Within Year - April 22, 2014 - National Mortgage Professional

Declines in home values experienced during the recession have already been, or are close to being, erased in almost 20 percent of metro housing markets nationwide as values continue to rise...

NAHB: 2014 to be a Strong Year for Housing - dsnews.com, Paul Salfen, April 7, 2014

The National Association of Home Builders (NAHB) delivered some good news Monday: 59 of the 350 metro markets have returned to or exceeded their last normal levels of economic and housing activity...

4 Million Homeowners Climb out of Negative Equity - LATimes.com, 3/16/14

The economy may be growing at a frustratingly slow pace, but one piece of it is booming: American homeowners' equity holdings — the market value of their houses minus their mortgage debts — soared by nearly $2.1 trillion last year to $10 trillion.

Buying a Home is now 38% Cheaper than Renting - forbes.com, 3/5/14

Is renting or buying a better financial bet? Every six months, Trulia's chief economist, Jed Kolko, runs the numbers...

Home prices show signs of topping out - CNN MONEY | JANUARY 28, 2014

Home prices in November 2013 were still up, but by a narrow margin, could prices be stabilizing?

Phoenix-area housing market tilts in favor of buyers - Catherine Reagor, The Republic | azcentral.com Jan 25, 2014

Houses exceed demand in some areas of the Valley, leading to more choices.

Credit-score tips for Arizonans working to ease debt - Russ Wiles The Republic | azcentral.com Jan 3, 2014

Why 2014 is a Good Year to Buy a Home - CBS MoneyWatch, Jan. 1, 2014

If you didn't buy a home in 2013, you may be kicking yourself now. Home prices climbed nationally an average of 13.6 percent in the past 12 months...

Real Estate Rebound - Home prices increase by most in seven years! - December 31, 2013 Bloomberg News

Home prices in 20 U.S. cities rose in October from a year ago by the most in more than seven years, signaling the real-estate rebound will keep bolstering household wealth in 2014.

2014, the Year of the Repeat Homebuyer - December 30, 2013 Trulia

As prices continue rising in the new year—albeit at a slower pace—investors will begin to ease back from the purchase market, but repeat homebuyers will be there to pick up the slack.

Rates Expected to Rise to 5.5% in 2014 - December 29,2013 Lifestyle Journal

There has never been a better time to refinance your home.

Home Price Increases Widen in September - October 31, 2013, DSnews.com

After taking a break in the summer, home price growth got back up to strength in September.

Housing Market Running at 85% of Normal, Pre-Recession Activity - October 9, 2013, DSnews.com

A new index from First American and the National Association of Home Builders (NAHB) suggests that about one in seven housing markets have returned to or surpassed their pre-recessionary levels of activity.

Existing Housing Sales Impact Homebuilders - October 30, 2013, SeekingAlpha.com

Despite the long and widespread downturn, it appears that the housing market is finally recovering from its lows.

Five-Month Home-Selling Slowdown Flattens in September with 26.6 Percent of Homes Selling in Two Weeks or Less - October 24, 2013, Redfin Blog

Sales within Two Weeks Dropped from 33.4 Percent in April to 26 Percent in August; then Late-September Mortgage Interest Rate Decrease Caused Buyers to Pick up the Pace

Competition Among Homebuyers Declined in September - October 22, 2013 Redfin Blog

Competition for homes declined for the sixth consecutive month in September, as the market continued to shift away from a frenzied, front-loaded, and seller controlled spring.

Existing Home Sales Slip With Affordability - October 21, 2013, DSnews.com

After reportedly reaching their highest level in nearly four years in August, existing-home sales dropped in September thanks to limited inventory and rising home prices, according to the National Association of Realtors.

Real Estate Boom in Phoenix Brings Its Own Problems - October 9, 2013, NYTIMES.com

Here, where the housing market endured one of the hardest crashes anywhere during the recession, the rebound has come faster than in most parts of the country…